MarketRisk

The MarketRisk Web (v2.0) introduces an innovative Product Selection Wizard, facilitating tailored investment choices. Users can select up to seven assets, including stocks and bonds, while the platform intelligently aligns their portfolio with personal risk tolerance. With back-tested performance reaching up to 16.3% annually, it serves as an invaluable research companion for savvy investors. A free demo version is available for exploration.

Top MarketRisk Alternatives

SYNDi Investment Ledger

SYNDi Investment Ledger streamlines investment portfolio management by effectively administering stocks, bonds, and short-term notes while generating timely reports for real-time insights.

Sensr Portal

The Sensr Portal revolutionizes investment management by streamlining the fund lifecycle, enabling seamless fundraising, capital calls, and data reporting.

NüWorkflow

NüWorkflow streamlines operations across various departments by addressing specific needs encountered within investment firms.

Chartsmart

This investment management software excels in providing in-depth technical and fundamental analysis of U.S.

CapIntel

Empowering advisors to elevate client relationships, this innovative platform enhances portfolio understanding through interactive visual comparisons.

Croesus

Offering a robust cloud-based portfolio management solution, Croesus empowers wealth management professionals with tools for modeling, rebalancing, compliance, and tax optimization.

KoreConX

It streamlines capital raising, compliance, and shareholder communications, while offering robust features like KYC, AML...

ValueOne

Users can effortlessly monitor progress, evaluate program effectiveness, and assess ROI by benchmarking against industry...

Boosted.ai

By analyzing vast amounts of data from diverse sources, it identifies critical trends and provides...

Wealthsimple Invest

By creating diversified portfolios across various asset classes, it aims to optimize returns while minimizing...

Update Capital

Investors enjoy a personalized dashboard, tracking cash flow, projections, and returns...

Engagement Analytics

With profiles of nearly 1 million active contacts, it delivers insights derived from 18 million...

FinlogiK

It streamlines processes, enhances portfolio management through analytical dashboards, and supports a wide range of...

Q4 IR Websites

It centralizes crucial data and streamlines meeting workflows, enabling users to identify ideal investors, effectively...

Irwin

Its robust platform enables teams to track shareholder changes, manage events, and engage directly with...

Top MarketRisk Features

- Product Selection Wizard

- Free online demo version

- Unique risk evaluation algorithm

- Tailored asset allocation guidance

- Customizable risk tolerance settings

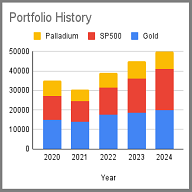

- Back-tested portfolio performance data

- Professional-level portfolio management

- Up to 7 investable assets

- Historical performance analysis

- Average annual return tracking

- User-friendly interface

- Risk limitation feature

- Comprehensive market price input

- Multi-asset investment options

- Research tool for investors

- Annual portfolio adjustment recommendation

- Performance data from 1929

- Insights from industry expert

- Tool for informed investing decisions

- Portfolio diversification support