ARGUS Taliance

ARGUS Taliance empowers real estate companies to efficiently manage fund performance and REITs through an intuitive interface. Users can model intricate investment structures, conduct scenario analyses, and generate precise distribution waterfalls. The software facilitates in-depth portfolio insights, enabling adjustments to investment entities and configurations for accurate forecasting and stakeholder reporting.

Top ARGUS Taliance Alternatives

Q4 IR Websites

Q4 IR Websites empowers investor relations teams with a robust platform to seamlessly attract, manage, and analyze investor relationships.

OneVest

This investment management software revolutionizes wealth management with its no-code configurability, allowing firms to tailor solutions to their unique needs.

Engagement Analytics

Engagement Analytics transforms investment management by leveraging behavioral intelligence and superior data quality.

INVRS

Designed to empower users in their investment endeavors, this software provides an intuitive eLearning platform that combines practical tools with engaging courses.

Wealthsimple Invest

Wealthsimple Invest provides a robust investment management platform designed for long-term wealth accumulation.

Irwin

Irwin revolutionizes investment management by streamlining investor relations through automation and insightful data access.

ValueOne

Users can effortlessly monitor progress, evaluate program effectiveness, and assess ROI by benchmarking against industry...

FinlogiK

It streamlines processes, enhances portfolio management through analytical dashboards, and supports a wide range of...

Croesus

Its customizable interface integrates seamlessly with third-party systems, enhancing data security and efficiency...

Update Capital

Investors enjoy a personalized dashboard, tracking cash flow, projections, and returns...

Boosted.ai

By analyzing vast amounts of data from diverse sources, it identifies critical trends and provides...

Sensr Portal

Investors enjoy a modern, personalized dashboard to track portfolios, investments, and returns, while limited partners...

KoreConX

It streamlines capital raising, compliance, and shareholder communications, while offering robust features like KYC, AML...

MarketRisk

Users can select up to seven assets, including stocks and bonds, while the platform intelligently...

Top ARGUS Taliance Features

- Portfolio performance tracking

- Interactive investment modeling

- Scenario analysis tools

- Custom waterfall calculations

- Detailed stakeholder reporting

- Multi-tiered investment structures

- Real-time market impact assessment

- Comprehensive REIT management

- User-friendly interface design

- Drill-down investment analysis

- Forecasting distribution per unit

- Dynamic reporting outputs

- Integration with funding sources

- Customizable investment configurations

- Efficient cash flow projections

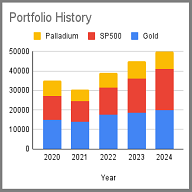

- Historical performance comparisons

- Cross-portfolio analytics

- Automated data updates

- Scenario-based decision support

- Advanced risk assessment features